Financial publications

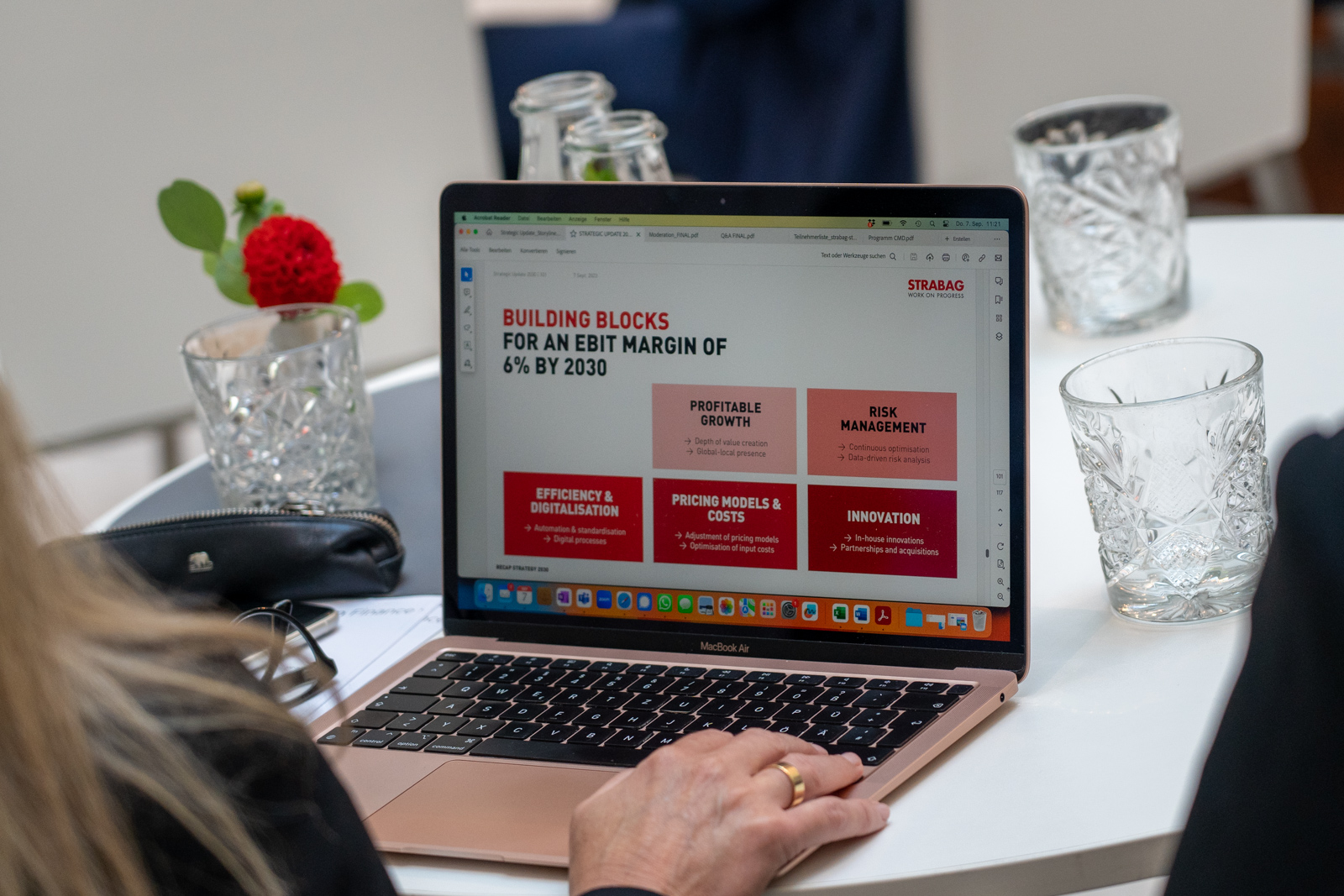

Your central source for financial information, reports, publications and presentations.

Online annual and sustainability report 2024

Find out first-hand about the European-based technology partner for construction services and discover what makes STRABAG special.

To the online report